As the New Year gets underway, it seems appropriate to write about changes we see in the year ahead. It is important to make note that this is not so much a forecast as an assessment of probabilities. Also, of course, the turn of the year is an arbitrary time for such a piece; important shifts in the economy and markets may not correspond with changes in the calendar.

This year, however, a seminal shift did occur at year's end, and that, of course, was the change in policy from the Federal Reserve. Following its mid-December meeting, in formal statements and in Chairman Jerome Powell's press conference, it was made clear that the Fed had reached the peak of its rate-hiking cycle and that rates cuts lay ahead as early as this year. Other central banks, on balance, indicated that they will follow the fed.

Markets React To Fed Pivot

Markets reacted as one might have expected: gold and bonds turned upwards, the dollar turned down, while stocks continued up, with both U.S. and global stocks closing the year at close to all-time highs. In the first week of this year, however, stocks here and abroad have declined along with gold as the dollar rallied. We see this week's action as a reaction to the exaggerated moves that followed the Fed's pivot, as well as, as always, some pent-up selling with investors waiting until a new tax year to lock-in gains.

On a longer-term basis, we expect the dollar to fall, gold and gold stocks to appreciate, and bonds, after a near-term rally, to resume their long-term decline that started after bond yields bottomed in mid-2020. The outlook for stocks is more mixed. Though stocks do not always fall in recessions, they are hurt by stagflationary periods. A slowing economy, along with stubborn inflation, will squeeze corporate margins from both the sales and cost sides. We expect rotation away from the U.S. and away from large-cap tech, in particular, favoring foreign markets, especially smaller markets, smaller-cap, and value.

The Federal Reserve's pivot is clear. As recently as September, a majority of Fed members, in their famous "dot plot," were calling for another rate hike in 2023, and some were calling for more hikes in 2024. The rate hike did not come, and by December, no members were seeing a hike this coming year, with the median forecast for 2024 rates of 4.6%. For 2025, the forecast is for 3.6% and down from there.

That's a dramatic shift, and multiple rate cuts expected over the next two years. What caused the change? It would be difficult to argue that economic reports between September and December demanded such a change in policy, although the Fed may have additional intelligence of a sharp deterioration coming in the economy and financial conditions.

It is also possible that political pressure was exerted ahead of the election. In a highly unusual intervention, Treasury Secretary Janet Yellen appeared on CNBC literally minutes before Powell's press conference, saying that with inflation declining to 2% soon, rate cuts were now necessary.

Fed Members and Market Agree on Aggressive Cutting Ahead

Pretty much everyone is foreseeing rate cuts this coming year, with the only questions being how many and when they start. To get from the current 5.5% to the median 4.6%, we would need four 25-basis point cuts. The Fed is embarking on rate cuts when the inflation-fighting job is nowhere near finished. Core PCE, which is the Fed's favorite measure of consumer price inflation, is still 60% above the Fed's own inflation target.

Not so long ago, Powell was adamant that the Fed would not cut rates until the 2% target had been reached, though over the months, he modified that. The Fed itself, per the "dot plot," does not see Core PCE at 2% until 2026 (though we would be surprised if it hit that target given the rate cuts the Fed members also project occur). It is unusual for the central bank to cut rates when the CPI is so high, other than in a recession.

By starting to cut rates soon, before inflation is vanquished, they risk a resurgence. Powell and Treasury Secretary Janet Yellen still talk about a soft landing, but it seems pretty clear that the economy is moving rapidly toward a recession. Many indicators point in that direction: credit card balances at all-time highs and delinquencies at more than a decade high; more auto loans underwater; continuing unemployment claims flat and high; bankruptcies up; manufacturing down across the country; sales of durables down; the savings rate now negative (for only the third time since after World War II); weakness in small business optimism; and so on. Yes, the unemployment rate is low, but so too is the labor participation rate. While most new jobs are either government or part-time, and many people are either working two jobs or underemployed. So, the jobs picture is not as rosy as it appears. And, as we have pointed out before, the unemployment rate is always at its low immediately before a recession.

Recession Looming After Long Lag of Monetary Policy

As we have emphasized many times, monetary policy famously works with long lags. The distance from the start of this tightening cycle is only the average of the lag until the onset of recession in all tightening cycles back to the 1960s. We might expect the lag in this cycle to be above average, given that excessively low rates for so long after the financial crisis of 2008 allowed households and corporations to refinance debt at lower rates and extend maturities.

Thus, higher rates have affected fewer people so far than would typically be the case. Rates only turned positive in real terms (net of inflation) in early summer.

But the impact will become increasingly evident as more people decide to replace (and finance at higher rates) a car or corporate debt matures and needs rolling over (at higher rates).

Most Global Central Banks to Also Ease Soon

Just as the Federal Reserve led the way among major central banks on the way up, so too it may lead on the way down. Although both the European Central Bank and Bank of England have been more hawkish in recent comments, we expect the ECB, in particular, to soften in the coming months. Some headline numbers look reasonably positive, but it is only in comparison with very weak levels a year ago.

The Bank of Canada has said it is likely to cut rates this coming year. By the end of the year, we suspect, the rate environment globally will have turned, except perhaps in Japan, where inflation is only now picking up significantly after years of ultra-loose monetary policy, and possibly China. This has significant implications for markets and asset classes worldwide. Having said that, there are reasons to believe that the market exuberance in response to the last Fed meeting may be a little overdone.

Some two-thirds of market participants are expecting one or more rate cuts by March, the second Fed meeting of the year. That's down from 88% immediately after the Fed's December meeting, but still a clear majority. Over 92% are expecting one or more cuts by the third meeting, ending May 1st, with a majority expecting two or more by then. I think the market is a little aggressive in its expectations. We shall see rate cuts this coming year, but I suspect the Fed will try to hold them off until the meeting in May.

Having said that, once rate cuts commence, the surprises will be on more frequent cuts rather than the opposite.

Extreme Optimism on the Stock Market

Stocks moved higher not only on the interest rate pivot but on the conviction that the Fed has engineered a soft landing and recession has been avoided. About 80% of global managers believe this. Not only managers but retail investors are exhibiting extreme bullishness, with sentiment indicators near the "greed" levels as we see the largest-ever inflows into the S&P ETF.

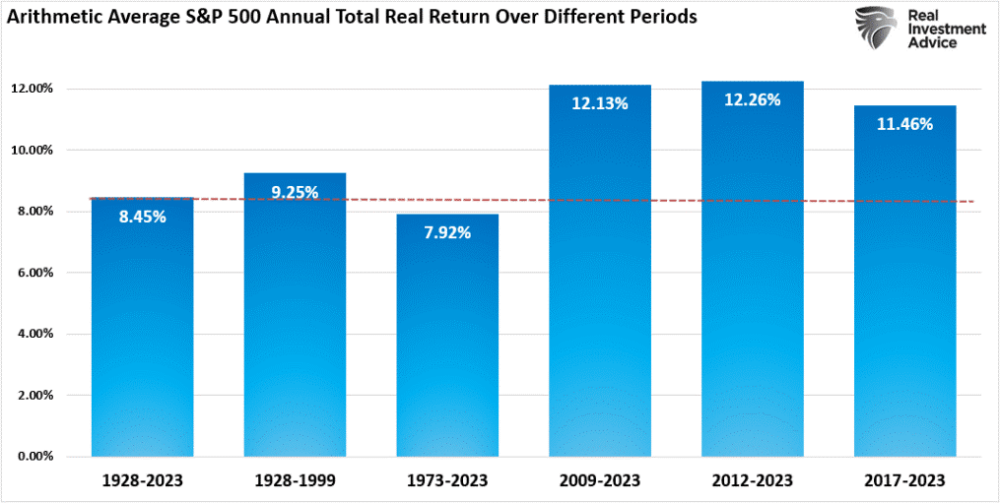

Retail investors are more bullish than professional investors. A poll of investors worldwide published by VisualCapitalist shows U.S. investors the most bullish of any round in the world, expecting long-run annual market returns from here of 15.8%. That compares with real-life returns for the last 30 years of just under 10% per year (including dividends).

So, there is a little optimism built in here. If the returns have been higher than long-term averages in the last decade or so, as shown below, might we not expect some reversion to the mean? It's certainly possible. Professional investors are not as bullish as individual investors, looking for 7% annual long-term returns. Most bearish of all, however, seem to be corporate insiders. Insider buying has collapsed to long-term lows, from 0.35% of total market capitalization in 2016 to less than 0.1% last year. In absolute terms, the numbers are not particularly significant, but when the people who most know their own companies are not buying stock, that signals something.

The underlying picture, however, is not as rosy as the headline numbers. The median stock return relative to the S&P return is the worst since the 1980s; more than 72% of individual stocks in the S&P underperformed the index return, and just seven stocks accounted for over two-thirds of the index gains in 2023. Despite the overwhelming belief in a soft landing, analysts are lowering their earnings estimates. We expect more earnings cuts in the coming year as the economy slows, hurting demand, while inflation remains stubborn, shrinking margins.

Although the S&P has risen in as many recessions as it fell since 1970 — typically falling sharply at the onset before recovering as sentiment for rate cuts increases — on average, recessions have seen stocks decline, with the average in the four losing recessions almost 22%. (In the 1969-1970 recession, the S&P lost 35%.)

Many are looking for the Fed pivot to spark a strong stock rally. It is worth noting that Fed pivots normally occur when stock prices are depressed or, at minimum, not elevated. So, a pivot usually produces significant gains. This time, the pivot comes with stock prices at extreme levels. James Stack notes that pivots in 1973, 2007, and 2001 also came when stock prices were elevated and had, in his words, "horrible market outcomes."

So, it is by no means clear that the market continues to rise from here. In the shorter term, occasions when the S&P had been at least 7% above its 40-week average or 4.5% above its 10-week average, as it is now, were usually followed by a significant decline.

So, the risk is high, both on a short-term but also a longer-term basis. We are expecting some decline in the market and, at best, a flat market for the year, while rotation out of the small number of market leaders already underway continues to the benefit of smaller cap and value. At a minimum, with the market priced for perfection, we can state categorically that the risk is high.

Markets Are Highly Concentrated

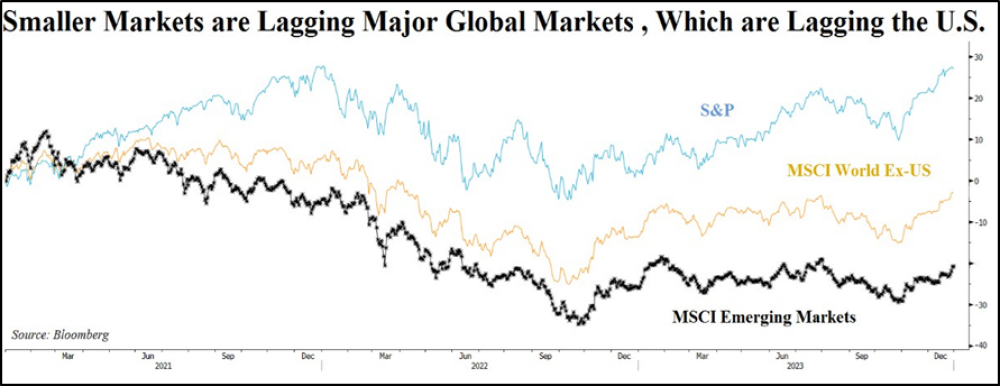

Some of the same factors affect most major global markets, which are also overvalued as their economies head toward recessions. The concentration is not anywhere near as great, however, as in the U.S. Over the past three decades, the U.S. market has increasingly dominated global markets, with U.S. stocks accounting for over 70% of global market capitalization, almost twice what it was in 1995. The trend has accelerated since the 2008 financial crisis.

In fact, the seven U.S. market leaders alone have more-or-less the same weighting in the MSCI world index as do the entire markets of Canada, Japan, the U.K., China, and France combined. This is an extreme anomaly that cannot last. Significantly, most of the increased U.S. market dominance has come from multiple expansions, as U.S. valuations became significantly richer versus the rest of the world.

On a price-to-earnings ratio, for example, the U.S. at 22 x is almost twice the rest of the world. The yield for international markets is over twice that for the U.S., and so on. These are significant differences. And the differences for small foreign markets are even more pronounced than for major developed markets.

So, we expect the rest of the world to catch up. But the better macro dynamics, as well as valuations, are in the smaller markets, including the commodity exporters. They tend to benefit when inflation remains stubborn but also when the dollar declines. It may be too early to rush headlong into such markets, but as rotation out of U.S. market leaders picks up apace, the money will go somewhere, and proportionately more will go into these smaller markets.

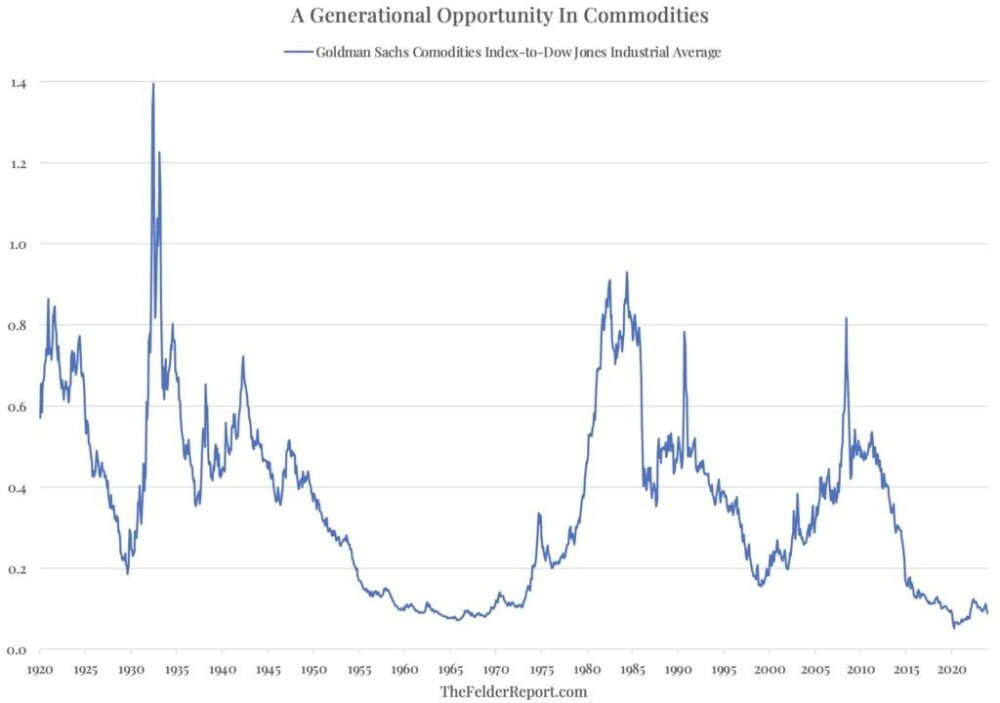

Commodities, always mixed, have been generally weak for the past year, some by significant amounts. Natural gas and nickel, for example, each fell by 45%. Reduced demand from China, the world's largest buyer of most resources, was one major factor. Step back, however, and one sees that commodities are selling at 100-year lows relative to stocks. There has been a decade of underinvestment in resources and that will play out with reduced supply in coming years.

The set-up for a strong multi-year broad move in resources is very real.

In particular, we like the copper setup. Sentiment has improved as demand from China has picked up. There, wire fabricators are operating at over 90% capacity for the first time since 2021, while local warehouse stocks are at decade-long lows. Importantly, however, as supplies dwindle while demand picks up, supply is hitting roadblocks. Anglo-American has cut its 2024 production estimates significantly, as others, including the largest producer CODELCO, are also cutting estimates.

On top of that, Cobre Panama, the world's eighth-largest copper mine, has been shut down by the government. We suspect it will reopen before 2024 is out, but in the near term, its closure will have a meaningful impact on supply. Quite suddenly, market expectations of a surplus in 2024 have reversed to forecasts of a deficit.

Gold: The Time Has Come

For nearly two years, we have been saying that gold will take off when the market believes that the Fed will change course on tightening before inflation is vanquished. We are at that point now. The Fed's pivot comes with the Fed's own preferred inflation measure at 60% above its own target. It is monetary factors, not geo-political, that will see a sustained move higher in gold.

Sentiment is changing — December saw flows into gold ETFs finally after more than a year of steady outflows — and technically, the picture looks very strong, with $2,000 a floor rather than a ceiling.

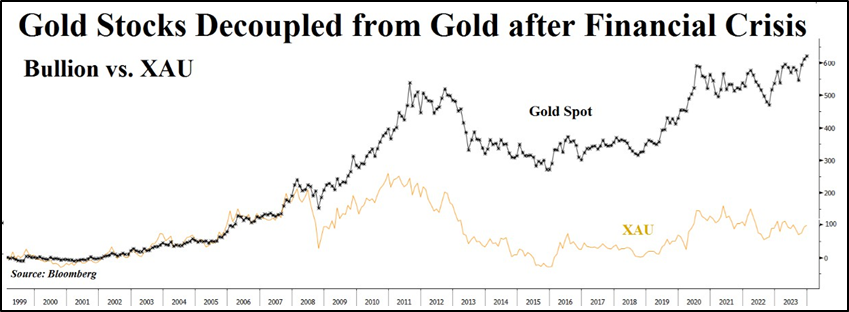

Gold stocks have lagged since the 2008 financial crisis, and even gold's powerful mover over the past year did not ignite the stocks until right at the end of the year. This should not surprise, given that most gold buying was from central banks and very wealthy Mid East and Asian families more concerned about safety than speculation.

But now, the monetary factors are coming to the fore, and gold stocks can do well. Notwithstanding a strong move at the end of the year, the gold stocks remain undervalued on both cash flow and asset bases and are under-owned. As gold stays above $2,000 for longer and convinces more and more investors, even small allocations into gold stocks will see them move up sharply. We only need to look at past moves in gold stocks to see how powerful they can be.

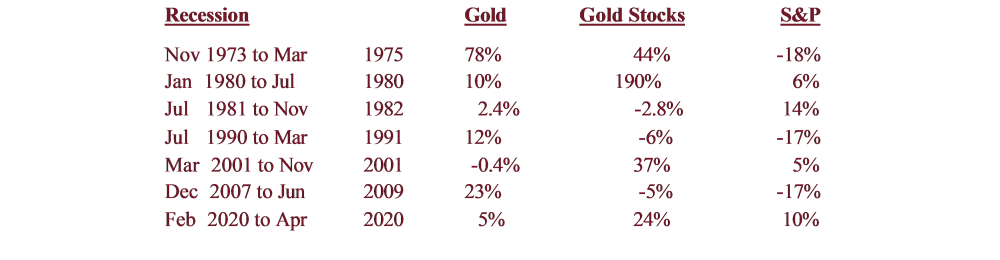

Returns on Gold Stocks Can Be Very Strong

From 1976 to 1980, gold stocks rose by 800% (per the Barron's Gold Stock Index). From 2000 to 2008, they quintupled (per XAU). From 2009 to 2011, it quadrupled. In just seven months in 2016, they almost tripled. The XAU index comprises the larger companies; the returns for the juniors can be far greater once the bull market gets underway.

It is also true, of course, that selectivity is more important with the smaller stocks. With an emphasis on the better quality, larger mining and royalty companies, and better-financed junior and exploration companies, we are well positioned for the gold bull market we see developing in 2024 and 2025. We do not need to be afraid of gold stocks during recessions. In the seven recessions back to the mid-1970s (see table above), gold stocks rose in a majority, with an average return (including the losing recessions) of over 40%.

Our Stock List Reflects Expected Scenario

Our Current Positions table reflects the views above. We are very heavily exposed to gold, both miners and royalty companies; we are well exposed to copper (through Barrick Gold Corp. (ABX:TSX; GOLD:NYSE), Altius Minerals Corp. (ALS:TSX.V), Lara Exploration Ltd. (LRA:TSX.V), and others) as well as other commodities (Altius, Franco). We are underweight in the U.S. market except for high-yielding Business Development Companies and have little exposure to global markets.

High-yielding stocks, that have the ability to maintain their dividends as the Fed and other central banks start to cut rates, will also perform well. On our list, we are gold and resource-heavy, anticipating a period of rate cuts that will spark the market.

As we have said several times over the past 18 months or so, gold will move up once the Fed cuts rates before inflation has been quashed. With the Fed's own favored measure of inflation 60% higher than its own target, we can hardly say that the job is finished.

High-Yielding Stocks Will Perform Well as Fed Cuts Rates

Our non-resource stocks are set up to do well or at least survive this environment. Ares Capital Corp. (ARCC:NASDAQ) (9.4%) and Gladstone Investment Corp. (GAIN: NASDAQ) (6.5% plus special dividends) are two Business Development Companies; this sector has generally done well during recessions as they are able to lend to better-quality companies shut out by banks. The high yields become more attractive when the Fed cuts rates.

Hutchison Port Holdings Trust (HPHT:Singapore), similarly, with its high yield (9.4%), will hold steady if the world does not fall into a serious recession, thus hampering global trade.

That threat, as well as increased U.S.-China tensions, is already reflected in the stock price, in my mind. All three companies are meeting their dividends from their relevant metrics (net investment income for the BDCs or free cash flow for Hutchison).

A Few Selected Global Stocks

We have two other global equities on our list, one very large cap, and the other small cap. We like both of the companies, which have solid balance sheets, clear strategies, and good management.

Nestle SA (NESN:VX; NSRGY:OTC) is the bluest of blue chips and is reasonably priced relative to its own historical valuations. The yield is just over 3%, the highest it has been since 2017. Nestle has increased its dividend every year this century. However, if we see a sharp downturn in the U.S. market, I would expect to see Nestlé's stock price fall meaningfully as well, if only temporarily. From its 2007 high, the stock fell over 36% before going to new highs again by early 2010.

Following the market declines after the dot-com bust, Nestlé fell almost 40% over the next ten months, finally exceeding its old highs three years later. There is little doubt that even a blue-chip like Nestlé will be hurt in a stock market bust; an economic environment of a sluggish economy and stubborn cost inflation will also be difficult for the company to escape.

Lastly, Kingsmen Creatives (5MZ:SGX), which was hard hit by the lockdowns associated with COVID-19, as one would expect for an entertainment company, has recently re-instituted the dividend suspended in 2020. It is making a comeback from that disastrous period. In a mild recession, it can sustain its post-covid momentum and remains very undervalued, selling at a single-digit price multiple and for only 50% of book.

As a small-cap stock in Singapore, it would likely be less affected by a U.S. market drop and could benefit from rotation from U.S. growth to foreign value. Obviously, a global stock collapse would hurt all stocks, and one would be better off in 100% cash. But in investing, we aim to assess risks and rewards and weigh probabilities.

We are comfortable with these five stocks, so we would not be surprised if we want to cut back as the year develops.

We Hold Gold and Resource Stocks in Many Sectors

Most of our holdings are in gold and other resources. These fall into varioud categories.

- Major royalty companies, including the "Big Three" gold royalty companies

(Franco-Nevada Corp. (FNV:TSX; FNV:NYSE), Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE), and Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX)); and various other royalty companies, including

Osisko Gold Royalties Ltd. (OR:TSX; OR:NYSE) (a distance fourth), Altius Minerals Corp. (ALS:TSX.V) (broadly diversified), Metalla Royalty & Streaming Ltd. (MTA:TSX.V; MTA:NYSE American) (gold and copper after its Nova acquisition), and royalty generator Orogen Royalties Inc. (OGN:TSX.V).

While all of the royalty companies include some resources other than precious

metals — Franco has about 20% of its revenues from oil and gas for example — the

percentages vary and the "gold royalty companies" aim for around 80% of

revenues minimum to come from precious metals.

The royalty companies typically perform well in market downturns but can also

exhibit steady appreciation and leverage in strong gold markets. This because the

business model is a low-risk one. But the companies are not without risk, as

evidenced in the recent market behaviour of Franco after the mine on which it

holds its largest stream was shut down. Each also has different characteristics.

Clearly, it is difficult to make generalizations about, say, Franco and Orogen, in

the one sentence. But we are comfortable holding all our royalty companies in

the period ahead.

Major Miners and Junior Explorers

- Major miners, which include two of the three largest gold mining companies in

the world (Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) and Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE)), plus two other large silver-oriented miners (Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ) and Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE), though I recognize that both, like most "silver miners"

receive most of their revenues from metals other than silver). If we are right

about gold and silver in the period ahead, then these stocks will perform very

well. - Lastly, we hold some developers and exploration companies, including Vista Gold Corp. (VGZ:NYSE.MKT; VGZ:TSX),

Midland Exploration Inc. (MD:TSX.V), Reservoir Minerals Inc., Lara Exploration Ltd. (LRA:TSX.V), and Almadex Minerals Ltd. (DEX:TSX.V). Both as companies and as stocks, they are far more idiosyncratic than the groups above. Some of our favorite resource

companies are in this group, while the stocks are also more likely to be sold for

their own reasons than the stocks in the groups above.

So gold and silver stocks, both miners and royalties, clearly dominate our list, and I am expecting them to do well this coming year. I also like copper, and we have exposure through other companies, including Barrick, Altius, and Lara.

There are great companies to be holding for the next year or two that may not be at great buying levels right now.

TOP BUYS now include Franco-Nevada, Altius Minerals, Orogen Royalties, and Lara Exploration. Coming next: Barrick is stalking prey again, while Osisko's new CEO comes a'calling.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of [Altius Minerals Corp., Franco-Nevada Corp., Osisko Gold Royalties Ltd., Orogen Royalties Inc., Agnico Eagle Mines Ltd., Pan American Silver Corp., Fortuna Silver Mines Inc., Lara Exploration Ltd., Metalla Royalty & Streaming, Midland Exploration Inc., and Almadex Minerals Ltd..

- [Adrian Day]: I, or members of my immediate household or family, own securities of: [All]. My company has a financial relationship with [All]. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.